A group health insurance covers the following expenses :

For more details about the expenses covered, you can view your policy handguide

No, group health insurance policy is usually not subject to waiting period be it for any Pre-Existing Disease condition (PED) e.g.: Diabetes, Blood Pressure, Heart disease, etc., or Specified Diseases e.g.: Sinus, Knee replacement, Cataract, etc unlike retail insurance. However, this might change if your organisation has opted for a waiting period. For more clarification, you can view your policy handguide.

Due to technological and medical advancements, certain treatments and surgeries can be administered and conducted within few hours without getting hospitalised. Examples include chemotherapy, cataract, kidney stone removal, dialysis, etc. These are called as Day care procedures and will get covered under the policy even if you get discharged on the same day.

Yes, COVID -19 is covered under the policy if you are hospitalised for minimum 24 hours and the SP02 level at the time of hospitalisation was less than 90.

No, the quarantine expenses like hotel isolation, RTPCR/other diagnostic reports, medicines, doctor consultation, etc would not be covered under the policy.

Most insurance policies do not cover OPD expenses like doctor consultation, pharmacy, lab test. But any such expenses incurred 30 days before or 60 days after hospitalisation will be covered under the policy. These expenses are termed as Pre and post hospitalization expenses.

No, any type of dental treatment/surgeries will not be covered under the policy. However, dental treatment due to disease/injury will be covered.

A policy e-card is a health insurance identity proof that holds your personal details, policy information and financial coverage under a health insurance plan. It offers cashless payment options to pay for your medical bills arising from hospitalisation and other treatment charges.

Please note that in case at any time you are unable to locate your Policy e-card, you may obtain the same from your assigned claims manager.

There is no limit on the number of times you can claim during the year.

No, you can get treatment at any hospital other than a hospital blacklisted by the insurer. But for a better experience and to avoid the hassle of paying first and then filing for a claim, it is always recommended to take treatment at a network hospital.

There is no harm to hold multiple health insurance policies. You have an option to choose the policy under which you wish to make the claim first. It is recommended to use your Group Health policy first, since claim settlement is faster and simpler as compared to your personal insurance. If the claim amount is higher than the sum insured under your group health policy on which you first made the claim, you can claim the balance bill amount from your personal policy.

Insurance companies have tie-ups with several hospitals all over the country as part of their network. If you take treatment in any of the network hospitals, the insurance company pays your (admissible) hospital bills to the hospital directly. You would only need to pay for the expenses not covered under the policy to the hospital. Cashless facilities are not available if you take treatment in a hospital that is not in the network.

Please follow the below steps for claiming cashless treatment:

Please follow the below steps for reimbursement of claims :

When a part of amount is not approved under cashless facility, you can subsequently, on discharge from the hospital, submit the claim for reimbursement.

Yes. During the year, in case you get married or have a new-born just intimate your HR for immediate addition in your policy.

No. You cannot add your parents on your own in the policy.

Once you leave the organisation, your group policy/corporate insurance will lapse and you will not be entitled to any benefits thereafter.

We at Healthysure have launched an industry-first Flexi Top-up Insurance which allows employees to personalize & upgrade their corporate health covers and enjoy continuity benefits post-employment.

In case of any correction relating to name, DOB, etc in your corporate health policy/e-card, please reach out to your company’s HR.

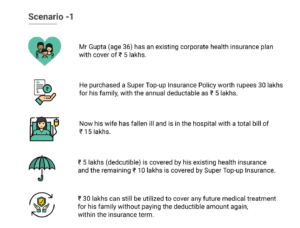

As part of your corporate health insurance program, you are eligible to voluntarily upgrade your existing health cover at own cost and increase sum insured by Rs. 30 lacs. When you choose to upgrade, you get an additional sum insured of Rs. 30 lacs (with deductible amount linked to corporate base plan) by way of personal super top-up from Manipal Cigna Health Insurance Company Ltd. This will prove to be a back-up cover in case of high-cost treatments such as cancer, heart/lung surgeries, kidney transplant, liver cirrhosis, COVID-19 etc. which can take one by surprise. There will be a waiting period of 2 years on pre-existing diseases and specific diseases.

The sum insured under the super top-up upgradation option is ₹ 30 lacs with deductible options of ₹ 1/2/3/4/5/10 lacs).

Deductible amount in health insurance is the amount of claim to be settled from existing insurance (corporate or personal) OR out of pocket before availing the benefits of personal super top up. Various deductible options available for the super top-up policy are ₹ 1/2/3/4/5/10 lacs.

The personal super top-up insurance policy is from Manipal Cigna Health Insurance Company Ltd. and created for members of Healthysure platform.

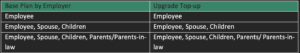

The upgradation option applies to the same family definition as selected by the employer. One CANNOT add family members as part of upgradation.

The personal super top-up will be available for Self-Spouse-Children (upto 4 children) and separately for Parents/Parent-in-law (however only one set of parents are allowed as covered under the base corporate policy i.e. both parents or both parents-in-law (cross combination of parents e.g.:- Father and Mother-in-law is not allowed).

The entry and exit age of the applicants of the policy is given below :

Once the super top-up is bought, the policy is annually renewable for lifetime (except for children where the exit age limit is 25 years).

No. Maternity is not a part of super top-up.

No. Adding family members to the base policy is not permissible.

Yes. You can choose to buy super top-up ONLY for self–spouse–children (upto 4 children)

Yes. You can buy separate policy – either for your mother or father or both considering the health conditions.

No. There will no loading on any of the pre-existing conditions.

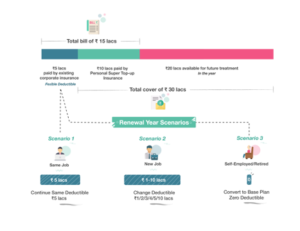

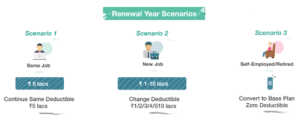

Members who upgrade the policy with personal super top-up have an option to continue the policy in personal capacity post-employment. The personal super top-up is renewable for lifetime & convertible to base plan post-employment.

Member can change the deductible limit to ₹ 1/2/3/4/5/10 lakhs on any renewal year of super top-up policy post completion of 1 year and can reduce the deductible limit to ZERO on any renewal year post completion of 2 years (subject to health assessment by way of self-declarations).

You may upgrade the corporate health policy with Healthysure in case you are in healthy condition as you will save upto 90% in premium over independent personal insurance and have superior claim experience with Healthysure. In case you have pre-existing health conditions, it is advisable to not upgrade with HealthySure (as you would be subject to 2 years of waiting period on pre-existing diseases) and rather continue with your existing personal health policy.

No, this is not possible as per the insurance regulations.

Yes. You will be able to renew the policy even the next year. However, you will have no option to change the deductible amount on the renewal year.

Medical Expenses of an Insured Person taken during hospitalisation due to Illness or Injury is within the Policy Year. We will also cover the Medical Expenses incurred towards a Medically Necessary Modern and Advanced Treatment of the Insured Person subject to Illness/ Injury being covered under Hospitalisation Expenses and the necessity being certified by an authorised Medical Practitioner.

The room category under hospitalisation would be up to single private room.

Yes, under Inpatient Hospitalisation the treatment for Psychiatric Illness is covered.

No. There is no co-pay applicable under the scheme.

Yes, the policy can be upgraded by employees in middle of the year. However, it is advisable for employees to upgrade the policy closer to the renewal month of corporate base policy.

Yes, new joinees shall be able to upgrade the policy at time of joining. The welcome email to new joinees will include the option to upgrade by way of super top-up.

Employees who upgrade the policy with personal super top-up have an option to continue the policy in personal capacity post-employment. The personal super top-up is renewable for lifetime & convertible to base plan post-employment.

Member can change the deductible limit to ₹ 1/2/3/4/5/10 lacs on any renewal year of super top-up policy post completion of 1 year and can reduce the deductible limit to ZERO on any renewal year post completion of 2 years (subject to health assessment by way of self-declarations).

The key benefit of group accident insurance plan is that it safeguards you against any financial liability that can arise because of disability or death due to an accident.

The group personal accident insurance covers-

An accidental death – Your family member will receive the compensation if any injury has costed your life.

Permanent total disability – In case of an accident and if that leads to permanent disability that continues for over 12 months (eg: Total paralysis, loss of sight of both eyes, etc) then the compensation upto 100% of SI (Sum Insured) is paid.

Permanent partial disability – If you get disabled partially (eg: Partial paralysis, loss of one eye sight, then 2%-70% of the total SI is paid by the insurer depending on the terms of the policy. It is applicable when the disability continues for over 12 months.

Temporary Total Disability - If you get injured that causes you to be completely disabled for a temporary and fixed amount of time (eg : Back injuries, Broken bones), then weekly maintenance fee is paid for period specified in the policy.

The accidents include road accidents, air accidents, falls, drowning, burns, stings, attacks, natural calamities, Bites, etc. The policy covers for accidents both off duty and on duty.

All the employees are covered under the policy.

No. The Group accident policy is self only policy.

Permanent Total Disablement shall mean either of the following:

a.Total Paralysis

b.Loss of sight of both eyes, or

c.Loss of two Limbs (both hands or both feet or one hand and one foot), or

d.Total loss of sight of one eye and loss of one limb (either one hand or one foot), or

e.Loss of speech and hearing of both ears

In case of Permanent total disability, the compensation payable is 100% of sum insured.

What are permanent partial disability under GPA?

This disablement is similar to Total Disablement but its partial in nature. E.g. Loss of one eye sight, loss of one finger, etc. The compensation payable will generally range from 2% to 70% of Sum insured. For eg: In case of Loss of one eye sight, compensation payable will be 50% of sum insured.

Temporary total disablement means the temporary and total inability of the insured member to engage in any occupation or any activity while he is under the regular care of and acting in accordance with the instructions or in written advice from the treating medical practitioner and is confined to bed.

Here are some of the common scenarios under which accidents and deaths are not covered:

Yes, the policy is valid at all places and at times during the validity period of the policy.

It will not be covered since the policy is restricted to accidents in India.

Yes. It is covered

Yes. Accidents due to natural disasters are covered in Group Personal Accident Insurance.

The services offered under Health and Wellness plan include :

Follow the below steps to avail the Health & Wellness Services:

The services are extended not only to you but you can also add max 5 family members as dependents.

Find the video https://www.youtube.com/watch?v=olmvR_xEJ4olink to get started with the app and avail the services.

No. You cannot upgrade the plan.

For additions during the year, a pro-rata premium is charged for the residual period of the policy.

For deletions, a pro-rata refund is credited to the employer’s ledger account with the insurer. This balance is used to adjust the cases of additions, if any. For any deficit that remains post adjustment, the balance needs to be settled instantly by the employer for processing of the additions. Surplus if any in the ledger account will be refunded at the end of the year.

The premium for next year will be a function of claims admitted in the current year. The insurer’s price algorithms will analyze the claim amounts, claim type, probability of recurrence and risk factor of the group profile.

The room rent restriction is expressed in terms of percentage of Sum Insured (SI) per day for Normal Rooms and ICU. Let’s take an example – say if sum insured (SI) is Rs. 3 lacs and room rent limit is 2% of SI per day for Normal & 4% of SI per day for ICU. If any employee is admitted to a hospital where per day normal room rent charges are Rs.8K whereas allowable room rent limit under the policy is Rs. 6K (2% of 3 lacs), then not just the room rent but the entire hospital bill (excluding medical consumables, diagnostic fees, medical devices) will be settled on a pro-rata basis in the ratio of allowable room rent (6K) to actual room rent (8K) i.e. 75%. This means 25% of the hospitalization bill would need to be borne by the employees out-of-pocket.

Read more about room rent capping.

Pre-existing diseases (PED) are such which are already known to the patient at the time of policy inception. Eg. Hypertension, Diabetes, Asthama, Thyroid, High Cholesterol etc. For any treatments that are linked to these PED conditions disclosed by the patient, the same would be subject to waiting period unless waived off. (Eg. Angioplasty for a hypertension patient).

Specific diseases (SD) are slow moving diseases where patients undergo planned surgeries such as removal of kidney stones and cataract. In many cases, the patient is even unaware that he is suffering from such health conditions and it does not bother him in short term unless the health condition aggravates. Unless waived off, these specific diseases are subject to blanket waiting period of 2 years regardless of patient aware/unaware of these conditions. An indicative list of such diseases are as follows:

1) Knee/Joint Replacement Surgery

2) Sinus, Tonsils

3) Kidney Stones

4) Cataract Surgery

5) Skin Tumours

6) Hysterectomy

7) Fissures

8) Hernia

9) Varicose Veins

10) Genetic Disorders

The waiting period is the time span in which the insured cannot claim the benefits of health insurance. For instance, the waiting period for pre-existing diseases in many policies is around 2-3 years.

Read more about waiting period here.

Co–pay or coinsurance is a certain percentage of the total claim amount which should be paid by the policyholder. The remaining amount will be paid by the insurance company. For example, you might have to pay 20% of the expenses and the rest is covered by your insurance company. This is called a 20% copay. Ideally, you should try to get a cover that has zero copay, which would mean that the entire amount, in the event of hospitalization, would be paid by the insurer.

Read more about co-payment here.

Pre -hospitalization coverage refers to the coverage of any expenses incurred by the policyholder before the hospitalization. Common costs like a consultation, diagnostics, etc., that have occurred during a fixed period of time before the hospitalization can be covered.

Post -hospitalization coverage refers to the coverage of expenses incurred after the policyholder has been discharged from the hospital. For ex, common instances like follow-ups, tests, and medicines fall under post-hospitalization coverage.

Read more about pre and post hospitalization here.

The room rent restriction is expressed in terms of percentage of Sum Insured (SI) per day for Normal Rooms and ICU. Let’s take an example – say if sum insured (SI) is Rs. 3 lacs and room rent limit is 2% of SI per day for Normal & 4% of SI per day for ICU. If any employee is admitted to a hospital where per day normal room rent charges are Rs.8K whereas allowable room rent limit under the policy is Rs. 6K (2% of 3 lacs), then not just the room rent but the entire hospital bill (excluding medical consumables, diagnostic fees, medical devices) will be settled on a pro-rata basis in the ratio of allowable room rent (6K) to actual room rent (8K) i.e. 75%. This means 25% of the hospitalization bill would need to be borne by the patient out-of-pocket.

Read more about room rent capping.

Pre-existing diseases (PED) are such which are already known to the patient at the time of policy inception. Eg. Hypertension, Diabetes, Asthama, Thyroid, High Cholesterol etc. For any treatments that are linked to these PED conditions disclosed by the patient, the same would be subject to waiting period unless waived off. (Eg. Angioplasty for a hypertension patient).

Specific diseases (SD) are slow moving diseases where patients undergo planned surgeries such as removal of kidney stones and cataract. In many cases, the patient is even unaware that he is suffering from such health conditions and it does not bother him in short term unless the health condition aggravates. Unless waived off, these specific diseases are subject to blanket waiting period of 2 years regardless of patient aware/unaware of these conditions. An indicative list of such diseases are as follows:

1) Knee/Joint Replacement Surgery

2) Sinus, Tonsils

3) Kidney Stones

4) Cataract Surgery

5) Skin Tumours

6) Hysterectomy

7) Fissures

8) Hernia

9) Varicose Veins

10) Genetic Disorders

The waiting period is the time span in which the insured cannot claim the benefits of health insurance. For instance, the waiting period for pre-existing diseases in many policies is around 2-3 years.

You suffer from high blood pressure but you manage to find a health insurance policy that covers your pre-existing disease, woohoo! However, there’s a catch. As per your policy guidelines, you have to wait 2 years before you can make a claim for any treatment that occurs because of your high-blood pressure.

What this means is that even if you suffer from a stroke, or any disease that is remotely connected to your current condition before the waiting period is over, your insurance company is not liable to pay for the expenses. Unfortunately, waiting periods are a common clause in most policies. The best choice here is to look for one with no or a minimum waiting period for your ailment.

Co–pay or coinsurance is a certain percentage of the total claim amount which should be paid by you, the policyholder. The remaining amount will be paid by the insurance company. For example, you might have to pay 20% of the expenses and the rest is covered by your insurance company. This is called a 20% copay. Ideally, you should try to get a cover that has zero copay, which would mean that the entire amount, in the event of hospitalization, would be paid by the insurer.

Read more about co-payment here.

Pre hospitalization coverage refers to the coverage of any expenses incurred by the policyholder before the hospitalization. Common costs like a consultation, diagnostics, etc., that have occurred during a fixed period of time before the hospitalization can be covered.

Post hospitalization coverage refers to the coverage of expenses incurred after the policyholder has been discharged from the hospital. For ex, common instances like follow-ups, tests, and medicines fall under post-hospitalization coverage.

Read more about pre and post hospitalization here.

Fill in the form below. Our team will get back to you in no time.